Research, business and society are gradually coming to realise that Artificial Intelligence (AI) is not just another generation of data processing technologies. It is a powerful set of pervasive technologies impacting the way individuals and society have behaved creating a set of customs, rules and laws governing their life and organisation.

The article Artificial Intelligence Beyond Deep Neural Networks by Naga Rayapati, Forbes Councils Member is enlightening of the level of awareness achieved:

Neural networks act as black boxes and are often not well-suited for applications that require explainability. Areas like employment, lending, education, health care and household assistants require explainability. In finance, machines predicting price changes is a significant win for companies, but without the explainability factor, it may be hard to convince regulators that it has not violated any regulations. Similarly, in transactions involving trust, such as credit card applications, one has to explain the reason for approval or rejection. In business applications, building the trust of a customer is critical, and decisions need to be explainable.

There is no better introduction to the standard that MPAI has set out to develop: Compression and Understanding of Industrial Data (MPAI-CUI) than this quote.

The standard intends to enable prediction of a company performance by filtering and extracting information from its governance, financial and risk data. Artificial Intelligence is a candidate technology to achieve that, but MPAI is open to other technologies. We live in a transition age and, while there is no doubt about the ultimate supremacy of AI technologies, at this point in time some traditional technologies may perform very well.

these are some of the needs MPAI-CUI can cover:

- Assess and monitor a company’s financial and organisational performance, as well as the impact of vertical risks (e.g., cyber, seismic, etc.).

- Identify clues to a crisis or bankruptcy years in advance.

- Support financial institutions when deciding on a loan to a troubled company.

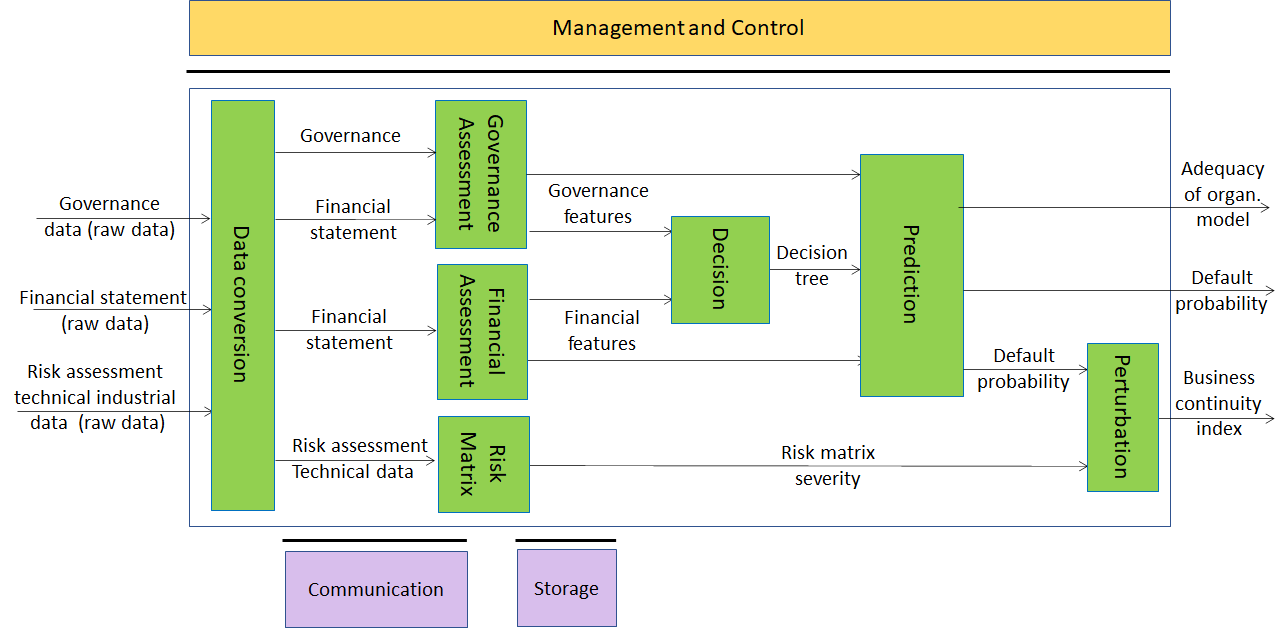

Referencing the article again, MPAI is not looking for a black box that uses neural networks. MPAI seeks technologies fitting an architecture that can be used without having to convince regulators that their regulations have not been violated. That this os possible can be seen from the MPAI-CUI architecture:

These are some of the technologies that MPAI has identified in the MPAI-CUI Use Cases and Functional Requirements document and requested in the MPAI-CUI Call for Technologies document:

| Data Conversion | Gathers data needed for the assessment from internal and external) sources, in different formats and covert it to a unique format (e.g., json). |

| Financial assessment | Analyses company data (i.e., financial statements) to assess the preliminary financial performances in the form of indexes.

Builds and extracts the financial features for the Decision tree and Prediction AIMs. |

| Governance assessment | Builds and extracts the features related to the adequacy of the governance asset for the Decision tree and Prediction AIMs. |

| Risk matrix | Builds the risk matrix to assess the impact of vertical risks (i.e., in this Use Case cyber and seismic). |

| Decision | Creates the decision trees for making decisions. |

| Prediction | Predicts company default probability within 36 months and of the adequacy of the organizational model. |

| Perturbation | Perturbs company crisis probability computed by Prediction, considering vertical risks impact on company performance. |

Interested? Join the Zoom conference on 2021/03/31T15:00UTC. you will know about

- MPAI’s approach to standardisation

- Presentation of Use Case and technologies requested

- How to submit a proposal

- The MPAI-CUI Framework Licence